The Case for Scenario Forecasting: Recovery Milestones Guiding F&B

The Coronavirus outbreak is a once-in-a-generation event that upended all industries: F&B included. The reality for S&OP teams is that forecasts used for demand planning have been rendered obsolete. Many demand planners have reverted to reactionary firefighting to deal with demand volatility caused by the pandemic. Moving forward, there remains a tremendous amount of uncertainty around what is to come, and when demand will return to the pre-outbreak baseline.

In this new reality, business leaders will improve their forecasting by creating scenarios and deploying human judgment. This approach will infuse agility into your demand planning process, validate short-term forecasts, and adjust medium-term forecasts when the recovery begins.

The Importance of Scenario Forecasting

Shifting to scenario forecasting starts with recognizing the information deficit you face in understanding the affect of the outbreak on demand for your product lines. Operational plans no longer reflect the situation on the ground. Human judgment has become critical; with this shift you must be able to hedge your planning to fit multiple future scenarios.

It is necessary to shift from complex to simple modelling due to the failure of historical signals and complex algorithms to accurately forecast this abnormal environment. Broaden the leading indicators used for forecasting by untethering shipment data as the primary source of demand. Leaders in F&B will actively engage both their upstream and downstream supply chain to capture a greater amount of demand signals, while incorporating wider recovery indicators such as the lifting of social distancing restrictions.

With the many unknowns of the outbreak and how economic conditions will respond, rather than relying on point estimate forecasts, carve out a minimum of four scenarios that build in several milestones, relating to the wider social recovery, that affect demand.

Focus on milestones that will indicate what recovery will look like across your channel mix. Generally, there has been a surge in retail accompanied by drastic cuts in the quick service restaurants, casual dinning, and food service contracting segments. Assure that you have a grasp of the events that will indicate when demand in your channel mix will begin to shift back to the pre-outbreak baseline.

Demand Recovery Milestones

Specific to F&B, four key events will dictate the progression of the demand recovery curve and the shifting of your channel mix towards the pre-outbreak baseline. These milestones are the return of seated dinning, reopening of public schools, the approval of large events, and the lifting of travel restrictions.

Seated dinning

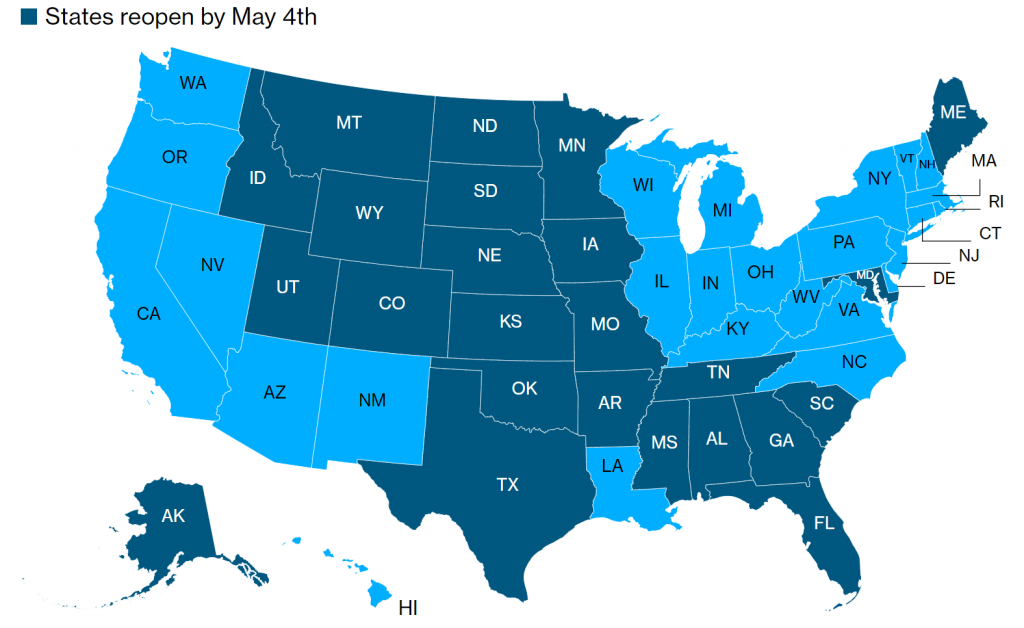

Seated dinning is making a tentative return across North America. Last week, many Midwestern and Southern state administrations authorized restaurants to reopen their doors to patrons; also, the Canadian province of British Columbia followed suit and began exploring strategies to reopen seated dinning.

Though these restaurants have initiated their return to regular operations, it will be a long road until seated dinning resembles the normalcy prior to the outbreak. Many states have put measures in placed such as capacity limits, personal protective gear requirements for servers, and removed condiments from tables.

The authorization to reopen has provided some relief to hospitality industry in these states; however, many restaurants are still stuck in a precarious financial position limiting their ability to generate revenue matching pre-outbreak levels. The National Restaurant Association estimated that as many as 10% of restaurant will close permanently as result of the pandemic.

Public Education

On April 27th, President Trump asked states to seriously consider reopening their public schools prior to the end of this academic year. Some states, such as Idaho and Wyoming, have heeded the call and are exploring options for students to return to the classroom before the summer. However, most states are planning to open their school systems by the beginning of autumn.

The argument to reopen schools is critical to kickstart economy as more parents can only fully rejoin the workforce when their children are back in class. Drawing insights from countries that have opened their public education systems, such as Germany, Denmark, China, South Korea, and Vietnam, schooling will look much different. Students and staff will be required to follow strict social distancing and personal protective gear measures, while being limited from attending school for the entire week.

When schools do reopen across North America, whether it be before or after the summer, it will look vastly different. Parents will still face hurdles around the ‘new normal’ of their children’s routine.

Large Events

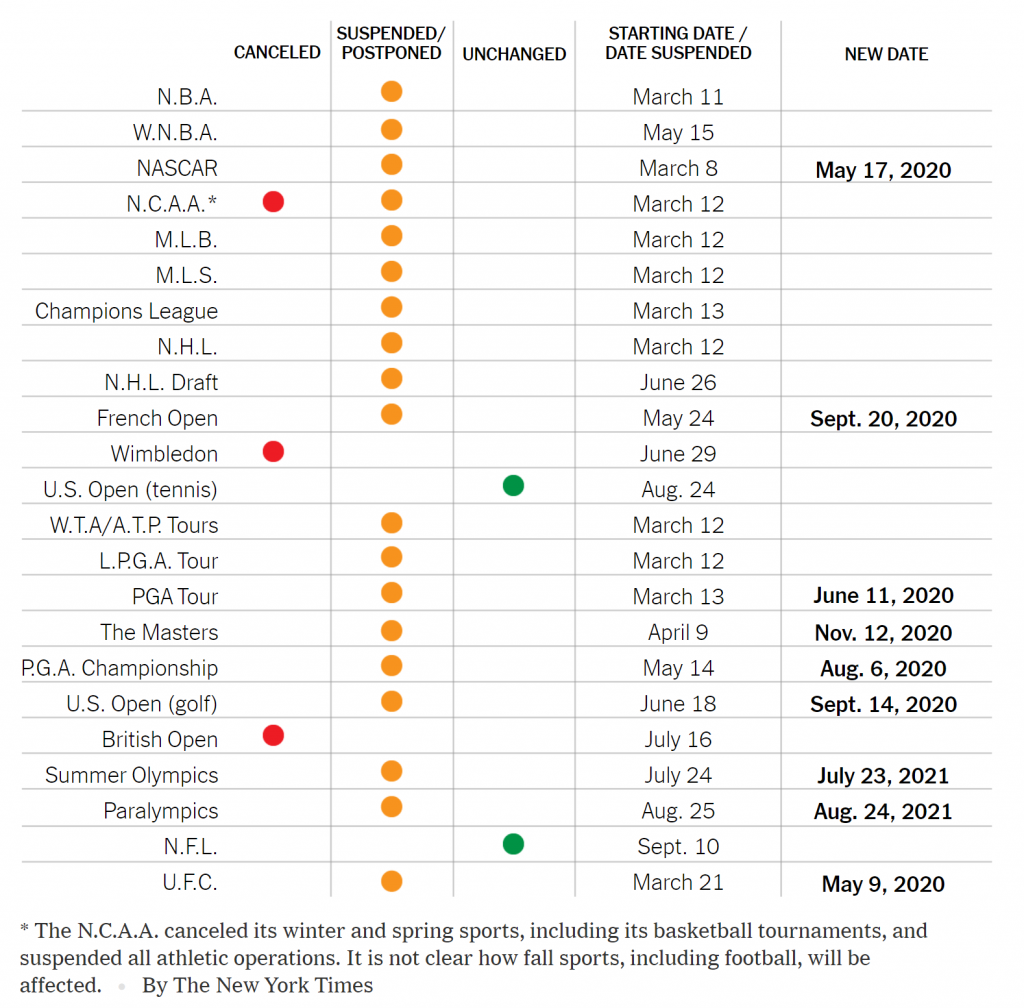

The outbreak has deprived many of needed escapes such as sports, concerts, community events, and other large gatherings. The ability to safely host large events during the outbreak hinges on the availability of rapid, accurate testing and wide-scale contact tracing.

Sporting leagues, such as the NBA, MLB, and NHL, may return by this summer as the testing capacity will be available to screen all athletes. Though, these athletes will be playing in front of empty stadiums in the foreseeable future.

Even with testing and contract tracing, a major event – drawing a crowd greater than 20,000 people – makes contract tracing highly difficult to near impossible. As result, many speculate that large events will only fully return when a vaccine is available.

Travel

International travel and tourism have been severally affected since the beginning of the coronavirus outbreak. The United Nations World Tourism Organization (UNWTO) estimates that the outbreak has led to the loss of 850 million to 1.1 billion international tourists.

The UNWTO also released a report stating that virtually all international tourism hotspots have imposed travel restrictions in response to the coronavirus outbreak. Many believe that these international travel restrictions will remain in place until 2021.

US Treasury Secretary, Steven Mnuchin, offered some reprieve for domestic travel. Mnuchin stated that travel could resume, initially limited to within the United States, as better conditions emerge in the third and fourth quarters. However, Mnuchin fell in line with other experts regarding travel outside the US, iterating that international flights would only resume with sharp improvement likely at the beginning of 2021.

Final Thoughts

Meeting the demand planning challenges of the coronavirus outbreak is a difficult task. The pandemic has undone point estimate forecasting necessitating the shift to scenario forecasting. By effectively incorporating a wider array of demand signals and planning for multiple future scenarios demand planners can remain ahead of the pandemic. Note the key milestones which will signal the beginning of demand recovery within your channel mix, and above all else stress agile and communication within your S&OP team.

About Fiddlehead Technology: Fiddlehead works with prescriptive analytics to find elegant solutions to some of the food and beverage manufacturing industry’s most complex problems. The result is more accurate demand forecasts, allowing companies to lower inventory, achieve higher levels of service, and improve their margins in an increasingly complex global market.