The Future For Fast-Food: An Outlook of the QSR Segment

Emerging trends within the quick service restaurant (QSR) segment since the coronavirus outbreak. What food and beverage manufacturers can expect in the future for fast-food.

When is the last time you sat down inside a McDonald’s? Or maybe you are partial to Burger King? What about Chick-Fil-A?

Regardless, it has been a long time since we have been able to eat inside some of our favourite fast food chains. The coronavirus outbreak has changed many aspects of everyday life: the quick service restaurant industry included.

As QSRs serve as pivotal downstream partners for food and beverage manufacturers, S&OP teams have been closely monitoring sales to gauge demand recovery, hypothesize whether similar trends will emerge across different markets, and assess what will be the lasting affects across the industry.

Here are the changes Fiddlehead is noticing among QSRs:

A Vicious Cycle

At the onset of the outbreak, QSRs were trapped in a cycle of partial closures to decreased foot traffic. Whether it was precautionary or mandated closures, many restaurants were forced to close their lobbies to seat-in dining. With a limited capacity to generate revenue, stores simultaneously saw a decrease in sales volume.

Service… 6 Feet Apart

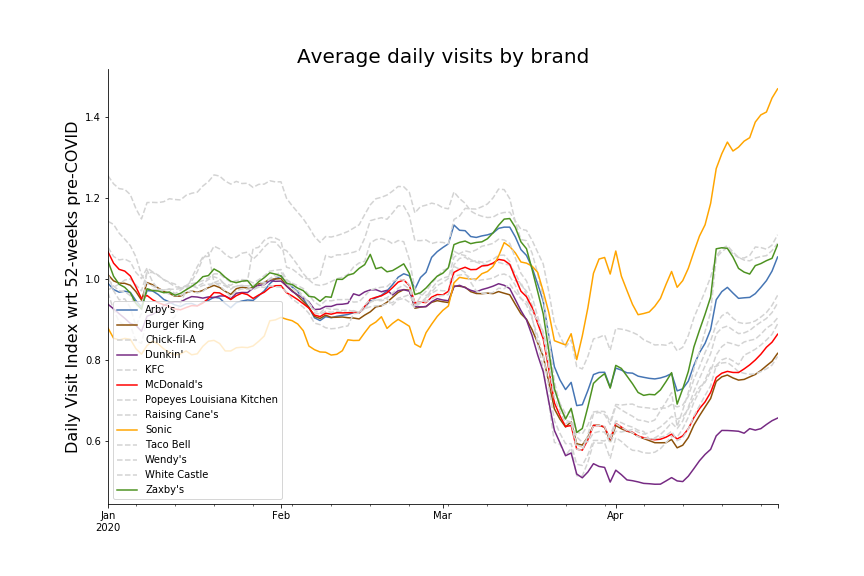

Conversely, as shelter-in-place orders have begun to be lifted, fast food chains have seen a surge in sales. In a year/year comparison, sales volume is presently higher than it was in June of 2019. A factor contributing to this is that consumers are still fearful to dine-in and view drive thru as a safer option. Sonic has capitalized on this greatly through their drive-in service and have brought back an air of nostalgia once again making the car the great haven for many Americans.

A Piece of the Digital Pie

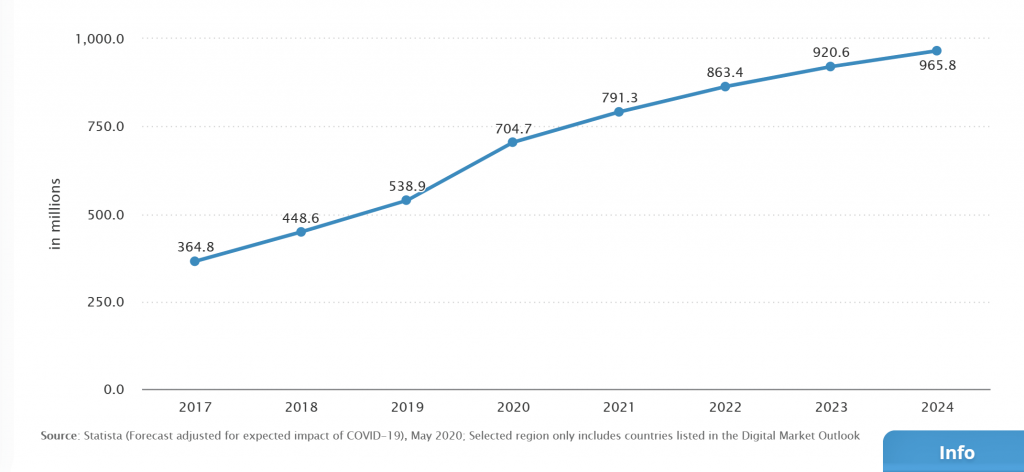

To capitalize on this opportunity, alongside drive thru, the majority of QSRs have adapted their business models to further incorporate curbside pickup and delivery to compensate for channel mix disruption. This proliferation of direct-to-consumer delivery has been fueled by social distancing orders and a pre-existing trend for such services prior to the pandemic. The year/year adopting of QSR and 3rd party delivery apps has increased by 165.8 million users since last year. This explosion equals a 30% increase in use.

With this surge in demand for food delivery, operators have turned to enhancing their own delivery apps or have partnered with 3rd party delivery services to fight for market share. These efforts have been supported by 3 main strategies to promote delivery:

Free Delivery Promotion – QSRs have turned to offering free delivery outright or have partnered with 3rd party companies to provide free delivery, barring a minimum order size.

Value-add Offers – QSRs have offered exclusive value-add promotions on delivery apps to encourage higher conversion rates and larger order sizes.

Preferred In-app Placement – QSRs have sought preferred placement within 3rd party delivery apps through securing partnerships with delivery providers to gain competitive advantage.

A Change of Tone

QSRs have shifted messaging; Companies have moved away from sniping at each other over social media, to promoting community outreach and safety across their mediums. This is done to assure a sense of familiarity and trust among customers. By combining brand building with value-based offerings and loyalty program promotions, QSR chains hope this will help to solidify their customer base while gaining additional market share in delivery.

Disinfectants & Temperature Checks

QSRs have had to make significant operational changes to continue servicing the public. Heightened regulations regarding sanitation, paid leave, and employee safety have burdened many QSR franchisees with rising operational costs and have bitten into margins.

In response, fast food companies have moved to simplify their operations through measures such as menu reductions to only core offerings. Also, to offset financial pressure QSR chains have taken action to support their franchisees. McDonald’s has offered rent deferrals plus operational feasibility evaluations for operators, while Subway has suspended royalty and advertising fees.

Weathering This New Landscape

The ability of QSR chains to continue to thrive in our new environment hinges on their ability to continue to digitalize their operations. The combination of minimal contact service and brand familiarity will allow consumers to get their takeout how and when they want. This is what will win tomorrow.

Granted, it goes without being said that QSRs will benefit from an enormous lift when they regain full operational capacity from the elimination of restrictions. Though, this is dependent on the efforts of government to mitigate future waves of outbreak through continued social distancing, virus testing, and contact tracing protocols.

Forecasting when the affects of outbreak will pass is a complex matter. This requires S&OP teams to incorporate a broader sample of leading indicators relating to wider economic recovery.

To assist, Fiddlehead Technology has developed the Recovery Dashboard – a modeling engine that aligns recovery planning to economic milestones, specific to F&B, signaling wider recovery through scenario forecasts. This provides demand planners with superior preparation to tackle the unknowns.

About Fiddlehead Technology: Fiddlehead works with prescriptive analytics to find elegant solutions to some of the food and beverage manufacturing industry’s most complex problems. The result is more accurate demand forecasts, allowing companies to lower inventory, achieve higher levels of service, and improve their margins in an increasingly complex global market.